-

Effective strategic planning for the closely held business owner should begin with a formal valuation.

-

The information gathered and considered in a business appraisal provides insights into the business overlooked in day-to-day operations.

-

Valuation studies provide an insight into the potential value of the business and roadmap to to becoming a ‘best in class’ enterprise.

You own a business. You’re deeply familiar with your company’s day-to-day operations, challenges, and triumphs. You have invested your time, energy, and resources into its success.

You may have a rough estimate of what it is worth, guided by your years of experience, what you know of your industry, what you hear on the grapevine and your gut instincts. (Stastics tell us that more often than not, your beliefs are pretty inaccuate.)

Valuation: the First Step to a Successful Strategic Plan

The business owner who really wants to understand the value of a business and make informed decisions, you need an objective, data-driven analysis. This is where a formal business valuation is usually indispensable.

A formal valuation tells you the value today, of course. But to the the owners of the business, it is, or should be, much more than that number. A formal valuation conducted by a Certified Valuation Analyst (CVA) or other qualified professional is a full diagnostic exam for your business. It yields information you won’t get anywhere else.

I am a lawyer, a certified valuation analyst, and a certified exit and succession planner. I have worked with the owners of closely held businesses throughout my career.

Contact me if you have questions about valuing your business, developing an exit plan, or implementing the legal bulletproofing necessary to protect your investment.

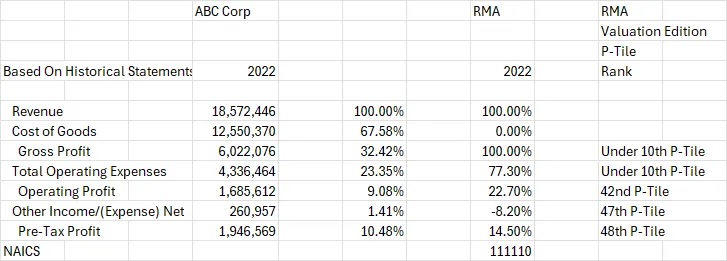

Here’s an example. A valuation focuses on comparisons to other similarly situation companies. Here is a snippet of analysis of key financial data from a calclulation report. It compares the performance of the company being valued with its competitors in the same industry in key areas using a percentage-based analysis.

A good, formal valuation drills down into a company’s financial and operational health, revealing insights that might otherwise remain hidden. This particular report tells us that this business is lagging on its ability to generate gross profits and that in other areas it is the middle of the pack.

Exceptional value in a business isn’t driven by mediocrity, and if and when the owners of this business try to find a buyer, these numbers will be reflected in a business that either cannot be sold or that is being sold at a much lower value than it could have brought.

A good valuation uncovers the real drivers of value, provides a roadmap for improvement, and highlights opportunities for growth. Here’s why a formal valuation is essential for closely held businesses.

Financial Analysis Reveals Key Competitive Data

A formal valuation goes beyond simple financial analysis. It assesses both tangible and intangible factors that impact the worth of a business’s. It is a holistic approach that takes into account a wide range of factors—financial statements, industry trends, market conditions, competitive positioning, and the unique traits of the individual business.

It gives a far more comprehensive picture than the internally generated reporting availability to most businesses. For example, we see here that a formal valuation tells the owner of a closely held business how the company’s cost structure compares with those of the industry. In reveals whether this owner is enjoying the same level of profitability .

Does it matter, for example, that a business is paying 40 percent more for its raw materials than comparable businesses in the industry? Of course it does. But, more importantly, what does the company need to do to address this weakness now that it has been identified?

The valuation report tells the owner what the company is worth today, but what it could be worth. Put to a good use, the valuation lays out the roadmap to get to ‘best in class’ and tells the owner what that is likely to mean for the profits and value of the company.

Here are some of the other critical issues that a valuation report should address.

Normalized Earnings: Clearing Up the Financial Picture

One of the first things that valuation will do is reveal the true earnings of the company from an objective perspective. In most closely held businesses, the owner’s compensation, discretionary expenses, and other personal costs are intertwined with the company’s finances. The real earnings power of the business, which is what drives value, may well be hidden.

The CVA will adjust financial statements by “normalizing” earnings. This process removes owner-specific expenses and other discretionary items and addes them back into the profit calculations. It gives a clearer, more accurate view of your earnings potential.

Why it matters: Understanding your business’s true profitability is critical for future planning. It allows for better decision-making regarding investments, growth, and long-term strategy. Investors and lenders look for normalized financials to assess your business’s actual value.

Risk Assessment: Uncovering Vulnerabilities

A formal valuation is a study in finding and assessing risk, much of which will be lurking beneath the surface of the company’s operations. Customer concentration, key person reliance, cash flow management, outdated technology, or legal and regulatory compliance issues all affect a company’s valuation because they are a reflection of its operations and stability.

Identifying these risks allows you to take proactive steps to mitigate them before they impact your bottom line.

Why it matters: Value and risk go hand in hand. The greater the risk in a business, the less it is worth. Risks like these are often hidden in plain sight and catch owners off guard. Defining and addressing the risk issues early improves the stability of the business and the potential fallout from turns in the economy, technology, or just risky financial practices.

Moreover, at those points in the life of a business when value is a critical issue, say during a sale, merger, or investment round, or when the company is seeking financing or negotiating loan terms, the risks in the business of a company are the critical consideration.

Finding the risks and strengthening the business makes the company more stable today and more valuable tomorrow.

Intangible Asset Valuation: Recognizing the Value of Knowledge and Reputation

Intangible assets likely can represent the greatest portion of your company’s value. Intellectual property, brand recognition, customer relationships, and even the collective knowledge of your trained and in-place workforce are the critical issue in assessing overall value.

A formal valuation enables the owners to understand the value these otherwise hard-to-quantify assets.

Why it matters: Innovation, reputation, and customer loyalty can drive a company’s growth and profitability far beyond what’s visible on the balance sheet. Recognizing their value helps you leverage these assets more effectively, whether for strategic growth, securing financing, or preparing for a sale.

Competitive Advantage: Where You Stand in the Market

Your business doesn’t exist in a vacuum. A comprehensive valuation examines your competitive positioning within your industry. It considers factors like your brand’s reputation, customer base, proprietary technology, and market trends. Knowing where you stand relative to competitors is crucial for maintaining and growing market share.

Good research can even. Identify your competitors in a specific market and it will provide valuable insight into what sellers received in specific transactions.

Why it matters: Understanding your competitive advantage enables you to focus on areas that keep you ahead of the curve. Whether it’s product innovation, improving customer service, or optimizing operations, these insights help you make strategic moves to enhance your business’s value.

The Value of Knowing Your Value

Having a formal valuation on hand does more than just provide a figure—it equips you with actionable insights to improve and enhance your business. Here’s how a valuation helps you in practical terms:

Strategic Planning and Growth

A business valuation provides a data-driven foundation for your strategic planning. Whether you want to expand into new markets, develop new products, or improve operational efficiency, knowing your company’s value helps you prioritize initiatives that will have the greatest impact on growth.

Example: If the valuation reveals that your company’s value is heavily tied to one product line or customer group, it may be time to diversify to protect against market fluctuations. Conversely, if the valuation shows strong potential in an underdeveloped area, you can focus resources to capitalize on that opportunity.

Mergers and Acquisitions: Negotiating from a Position of Strength

Whether you’re considering buying another company or selling your own, knowing your business’s true value gives you leverage in negotiations. A formal valuation ensures you enter discussions with a solid understanding of fair market value, allowing you to negotiate deals that maximize return on investment.

Example: If you’re looking to merge or sell, having a well-supported valuation can prevent undervaluation and ensure you don’t leave money on the table. For acquisitions, it gives you the clarity to avoid overpaying for a target company.

Succession Planning: Ensuring a Smooth Transition

For closely held businesses, succession planning can be challenging. A formal valuation provides a clear, unbiased picture of the company’s worth, which is critical when planning an ownership transition—whether within the family or to outside buyers.

Why it matters: Succession often involves transferring wealth and ownership to the next generation or key employees. Having a formal valuation helps to ensure fair treatment of all parties and minimizes family conflicts or disputes among stakeholders.

Accessing Capital: Attracting Investors or Securing Financing

When seeking investment or financing, presenting a formal business valuation signals to potential investors or lenders that your company is well-managed and financially sound. It offers credibility and provides reassurance that they’re making a sound investment.

Why it matters: Whether you’re pursuing traditional bank financing or equity investment, a formal valuation strengthens your case and can result in better financing terms or higher valuations from investors.

The Business Divorce Law Report

The Business Divorce Law Report