-

The benefits of exit planning and succession planning are more than improving the prospects for a future sale at a good price.

-

Closely held business owners that implement the Value Acceleration Methodology can expect to improve profits now and to free up more of their own time.

Succession and exit planning are critical steps that enable the owners of closely held business to maintain and preserve the financial and social legacy of the enterprise they built. Whether the goal is to retire, to move on to another venture, or simply reduce the need for day-to-day involvement in running the operation, exit planning strategies are key.

Perhaps even more important, exit planning is good business. Thomas Deans, writing in Every Family’s Business, cautions that every business should be ready for sale every day and, if the price is right, the owners should consider a sale.

Perhaps even more important, exit planning is good business. Thomas Deans, writing in Every Family’s Business, cautions that every business should be ready for sale every day and, if the price is right, the owners should consider a sale.

Exit Planning is Good Business

The point is this: If a business isn’t ready for a sale, then the owners are leaving money on the table. Not just as in someday, but as in today. The hard fact is that most business owners have a disproportionate amount of their personal wealth tied up in a business that statistically they are unlikely to be able to sell.

Many businesses simply close their doors at the end of their founder’s work life, an unnecessary and avoidable result.

Here is an example to illustrate my point. Max Campbell owns a successful garden center, Campbell’s Garden Center. It is well located and has good traffic. Let’s assume that he buys from wholesalers to leave the real estate variable. Let’s also assume that the business is a pass-through entity taxed as a partnership to take out the income tax variable.

I am a lawyer, a certified valuation analyst, and a certified exit and succession planner. I have worked with the owners of closely held businesses throughout my career.

Contact me if you have questions about valuing your business, developing an exit plan, or implementing the legal bulletproofing necessary to protect your investment.

Max has annual sales of $2.8 million. He and his wife work full-time in the business, earning $220,000 a year as wages, and given the work and responsibilities, these are generally in line with the broader market. At the end of the year, there is typically another $200,000 in profits that they take out.

A rule of thumb is that Garden Centers sell for 3 to 5 times the seller’s discretionary earnings, that is the money that they can take out of a business as income or have available for reinvestment. The median profit margin for a business is 4%.

Working with an Exit Planner

Matt brings in an exit planner; they conduct a valuation and examine the business. They find that business depends on highway traffic and some keyword advertising for sales. It has some commercial business, mostly owners of garden apartments, but by and large its customer base is comprised of homeowners who do most of their purchasing between March and July.

There is no client relations management system, no formal marketing plan, and no succession plan. The owners work as many as 80 hours a week during the busy season, much less during the off season. The business has growth rates generally in line with inflation, of 2.25% in annual profit, but its net profit margins are below the industry median.

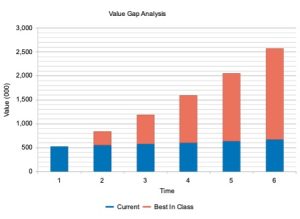

Assuming the business was saleable, and that is a big assumption, the exit planner estimates its value at about $500,000 to $600,000. That tells us that what Matt really owns is a job, not a business.

What’s the exit planner’s approach? A successful exit plan with improved margins and a 5% percent rate in profit growth puts the value of the company after five years in the range of $1.6 million. And that number could increase dramatically in a strategic purchase by a competitor or larger chain.

What’s the exit planner’s approach? A successful exit plan with improved margins and a 5% percent rate in profit growth puts the value of the company after five years in the range of $1.6 million. And that number could increase dramatically in a strategic purchase by a competitor or larger chain.

It’s not easy, but experience tells us that this result is achievable. At the end of the successful exit planning process, the owners can expect to spend far less time working in the business and they should have doubled their annual profits and increased the value almost threefold.

Mike Campbell can then sell, or not. He is now in a completely different position than he was at the start of the process.

My illustration is hypothetical, but it is the experience of those who work as exit planners that a doubling of value is a general benchmark and there are success stories of owners who increase the value of their business by eight times.

Exit Planning Using Proven Strategies and an Extended Network of Professionals

The Exit Planning Institute (EPI) has developed a comprehensive, multidiscipliary framework for developing a robust exit strategy. It focuses on maximizing value, ensuring business continuity, and preparing for the future. EPI’s network of advisors includes lawyers, wealth consultants, value analysts, insurance advisors, merger and acquisition firms, family business consultants, accountants, and management firms.

EPI employs a process known as strategy for business value enhancement that can increase the value of some businesses by 2 to 8 times when implemented.

This framework serves as the backbone for business owners ready to step away from the day-to-day responsibility for their closely held enterprise, enabling a seamless transition that safeguards the owner’s legacy and financial security.

Understanding Succession and Exit Planning

Succession and exit planning is the process and implementation of course for the transition of business leadership and ownership. The owner, or owners, plan for the eventual transfer of control, in large part by assuring that the assets of the business are protected and stable and ensuring that the business continues to operate successfully without the current owner.

Effective exit planning also incorporates the personal and financial goals of the owner after exiting the The aim is to create a plan that aligns with the owner’s personal goals, the business’s needs, and the future leadership’s capabilities.

The Exit Planning Institute Framework

EPI provides a well-documented approach to exit planning, emphasizing the need for a well-rounded strategy that encompasses various facets of the business and the owner’s life, which is implemented through the services of Certified Exit Planning Advisors (CEPAs).

The EPI approach is a multidisciplinary process known as the Value Acceleration Methodology. It certifies individuals in the planning process and provides them with the tools and resources needed to effectively guide business owners through their exit planning journey. CEPAs are found in a variety of related professions, including law, accounting , financial planning, and business consulting.

The CEPA will will coordinate the discovery, valuation, and planning processes and supply services within the advisor’s area of expertise. (My personal areas of knowledge concern the law, value analysis, exit planning.)

The CEPA implementing the exit plan then guides the owner through implementation using shorter and longer-term planning and incorporating a series of 90-day “sprints” in which discrete projects are used to meet broader goals.

Using a Multidisciplinary Approach to Exit Planning

It is a process that will involve a variety of professionals. Depending on the needs of the business owner, these may involve trust and estate planning, accounting, tax planning, valuation, business management, wealth planning, family business dynamics, and insurance.

In addition to the business issues, CEPAs work with owners to develop their “next chapter plan,” in which they define and implement their personal goals after they have exited the business. This planning involves the examination of the owner’s finances and personal goals.

The process takes time. Three to five years is common. At some point, the owner will be confronted with the sell or continue questions. Many, who are now making more money and have more free time, decide to keep the business or continue to make it grow.

For those who decide to exit, the CEPA coordinates the transition. They will work with business brokers, merger and acquisition firms, and other sources of buyers to find the right purchaser.

Selling or Transferring the Business

Options for exiting the business include sales to buyers as a turnkey operation, sales to strategic buyers, sales to private equity firms, sales to employees through Employee Stock Ownership Plans (ESOPs), or passing the company on to family members.

While no one can predict the specific outcome of an exit plan in a vacuum, the fact is that with the right information, it can be forecast with reasonable accuracy. The process is not speculative, it is planned and implemented.

Statistics compiled by the EPI point to the fact that only 1 in five business owners seeking to sell their business will find a buyer. I see it in my own practice representing closely held business owners that many owners, perhaps most, will liquidate the assets of their business as best they can and walk away.

The Business Divorce Law Report

The Business Divorce Law Report